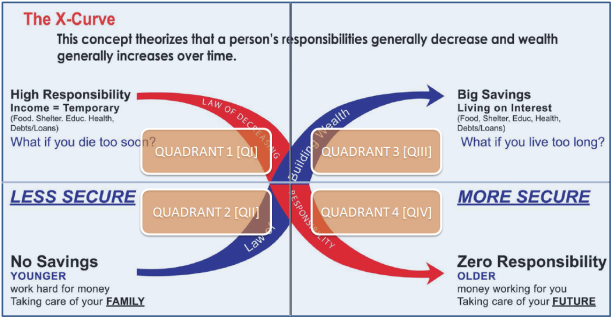

In wealth building one must understand the importance of the relationship between our responsibilities and the amount of wealth we have created. This concept is called the X-curve concept. What is the X-curve concept?

The X-curve is a graph showing two major lines in our lives: the wealth or savings line and our responsibility line. It is shown that ideally from younger to older years, our wealth and savings line should go up while our responsibility line simultaneously should go down.

The X-curve is divided into 4 quadrants. Quadrants I and II represents our younger years while III and IV represents our older years.

“I’m now retired! I have no more income. I will also retire eating and taking a bath! What a comfortable life!” (sarcasm intended)

2. QII: in quadrant II, typically when we are young, we have little to no savings at all. That’s why we work hard for money to provide for our family and ourselves. During our younger years, we are very less secure. The question we need to consider is:what if we die too soon? Are we prepared? Is our family ready? Who will take care of them?

3. QIII:due to the challenges in our younger years, we need to solve this dilemma by moving to quadrant III. From younger to older years, we need to build wealth, we need to build our savings and investment lines. The goal is to accumulate enough savings that will support us during our retirement years. With enough savings and investments, we pair it with the right financial knowledge we can then move to quadrant IV.

4. QIV:in this quadrant having the right financial knowledge and enough savings and investment, we can enjoy a life of zero responsibilities. Why? Because this time, we now let money work for us. How?